Introduction to Pricing Options on Futures

Options trading can seem complex, particularly when it comes to understanding how pricing works for options on futures contracts. In this post, we will explore the key elements of pricing options, specifically focusing on S&P 500 Mini Futures contracts. This will help demystify the process for traders and investors alike.

The Point Value of Futures Contracts

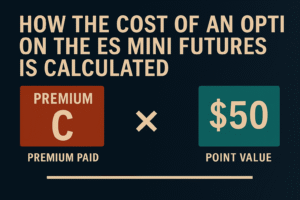

At the heart of pricing options on futures, such as the S&P 500 Mini Futures, is the concept of point value. Each futures contract has a specific point value—a multiplier that determines the actual monetary value of a change in the index. For instance, the S&P 500 Mini Futures typically carry a point value of $50. This means that for every point the future moves, the value of the contract changes by $50.

How At-the-Money (ATM) Call Options Are Priced

To illustrate how options on these future contracts are priced, let’s examine an at-the-money (ATM) call option. An ATM call option is one where the strike price is equal to the underlying asset’s price. In the case of the S&P 500 Mini Futures, if the index is at 4,000 points, an ATM call option would likely have a strike price of 4,000.

The cost of this option would depend on several factors, including the point value. Thus, if the pricing model or option chain indicates a premium of $20 for the option, with the point value of $50, the total cost to the trader would be $1,000 for that contract (20 points x $50).

Understanding how option contracts on futures are priced might seem daunting at first but futures traders are already familiar with the idea that different future contracts have different point values so transitioning to understanding how the cost of an option for that futures contract is calculated is not that difficult. You just need to remember that the point value is the multiplier for determining the actual cost of the option unlike options on stocks where the multiplier is a fixed 100.