The Great Trading Lie: Why ‘More Buyers Than Sellers’ is a Myth (and What Actually Moves Price)

If you believe price moves because there are more buyers than sellers, you aren’t trading—you’re being farmed. In modern markets, that sentence is a complete lie, a “pranked myth” designed to keep retail traders providing exit liquidity for the pros. To stop being the “bag holder” for institutional players, you must stop looking at charts as a collection of random green and red candles and start seeing the war between aggressive and passive money.

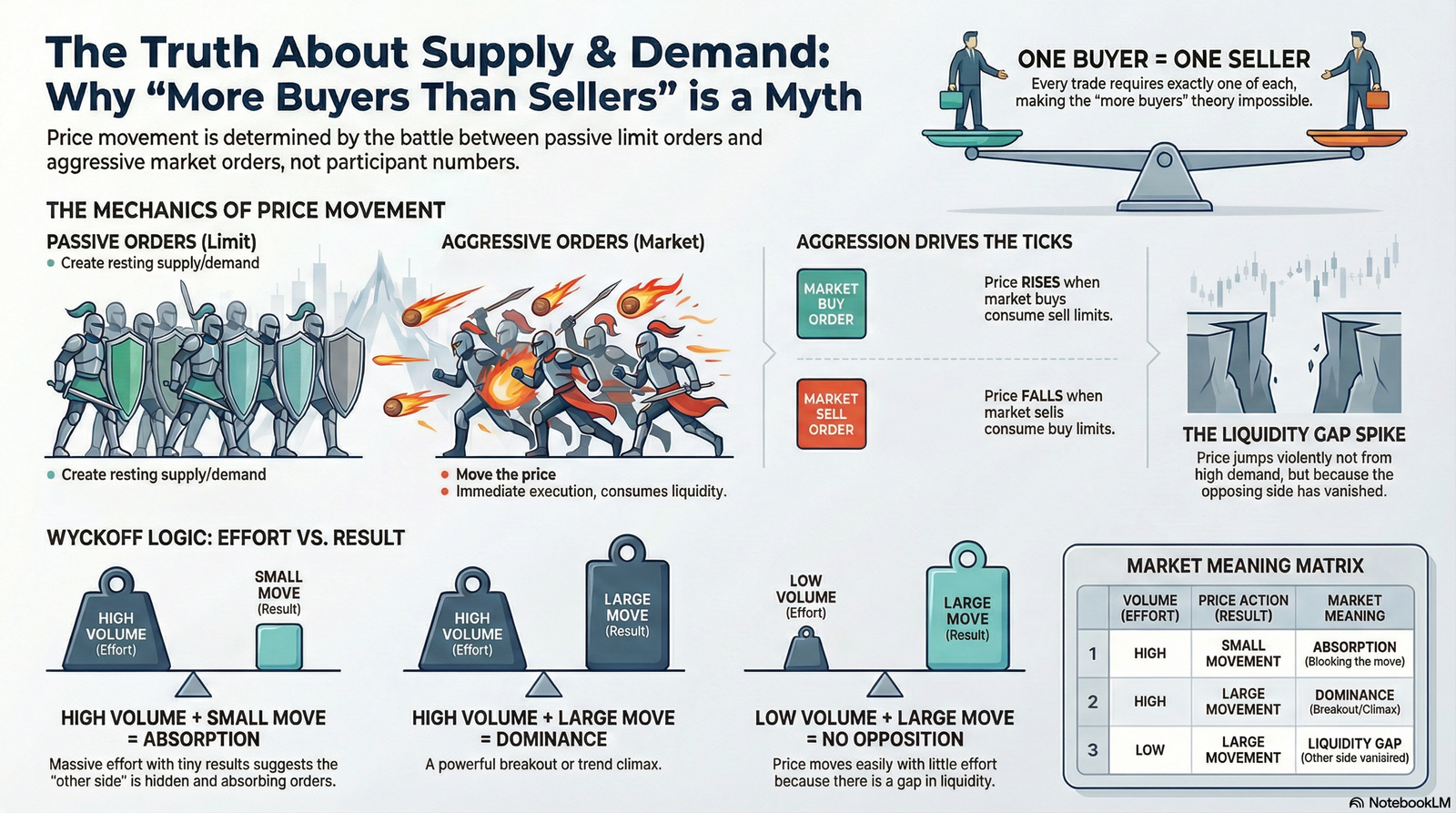

The 1-to-1 Reality of the Exchange

Let’s dismantle the biggest lie in finance with a single mathematical fact. On any regulated exchange, it is physically impossible for there to be “more buyers” than sellers in terms of executed trades.

“On any exchange for every trade there is one buyer and one seller. The quantity bought equals the quantity sold always.”

Every time a contract or share changes hands, there is exactly one buyer and one seller. If 10,000 shares are bought, 10,000 shares must be sold. The quantity is always in perfect balance. Price doesn’t move because a magical extra buyer appeared out of thin air; it moves because one side becomes more aggressive. The “lightbulb moment” here is understanding the Bid and the Ask. Price only moves when someone is impatient enough to “cross the spread”—meaning a buyer hits the higher “Ask” or a seller hits the lower “Bid.”

The Battle Between Patient and Impatient Money

To understand market microstructure, you have to categorize participants by their level of desperation. This is the divide between Limit Orders and Market Orders.

• Limit Orders (Patient Money): This is where real supply and demand live. These are “resting” orders. A limit buyer says, “I’ll buy here or lower,” and they wait. They build the order book but do not move the price.

• Market Orders (Impatient Money): These are the “movers” and “attackers.” A market buyer says, “Fill me now; I don’t care about the price.”

Price movement occurs when market orders consume the resting limit orders. But here is the professional secret: Stop-losses are actually just forced market orders. When a short seller’s stop-loss is triggered, it becomes a market buy order. This is how you get “short squeezes”—forced buying on top of real buying. Conversely, when long traders’ stops are hit, they become market sell orders, creating “liquidation cascades.” You aren’t seeing “more sellers”; you’re seeing a chain reaction of impatient, forced exits.

The Ghost Town Effect (Liquidity Gaps)

We often assume a violent price spike is a sign of massive strength. Sometimes, however, price moves aggressively not because one side is strong, but because the other side has simply vanished.

Imagine a supermarket where water is $1. If the suppliers disappear and the shelves go empty, you don’t need a thousand thirsty customers to drive the price to $5. Just two or three buyers are enough to cause a massive spike because there is “No Supply.” In trading, we call this a Liquidity Gap. If sellers pull their limit orders, the “Ask” side becomes thin. In this environment, even a tiny market buy can push price way up. These gaps are often where trends suddenly reverse, as the price moves through a “ghost town” with no real opposition until it hits a hidden wall.

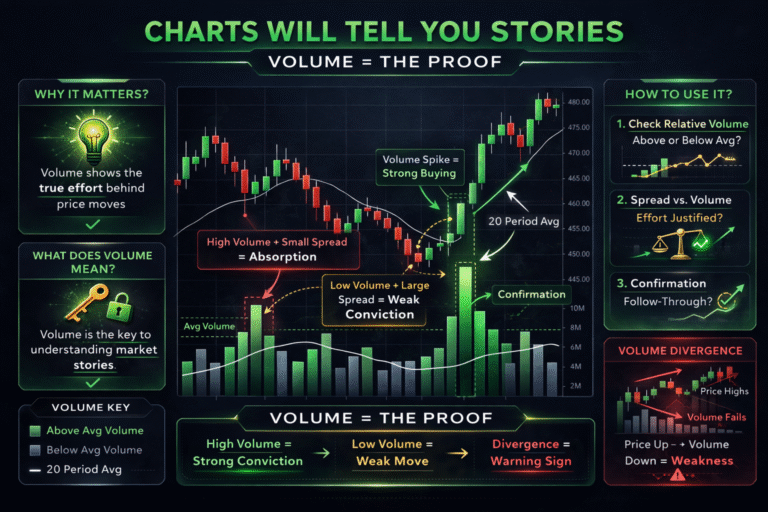

The Wyckoff Secret: Effort vs. Result

Richard Wyckoff’s most powerful tool for reading the tape was the relationship between Volume (Effort) and Price Movement (Result). By comparing these two, you can see who is winning the battle:

• High Volume + Small Price Movement (Absorption): This is massive effort for a tiny result. One side is attacking, but the other side is “absorbing” the blow with a massive wall of limit orders. If you see huge buying volume at resistance but the price “closes weak” or fails to break through, there is a hidden wall of institutional supply.

• High Volume + Large Price Movement (Dominance): Huge effort meets huge results. This is the signature of a dominant side winning the war, often seen in powerful breakouts or “climaxes” at the end of a move.

• Low Volume + Large Price Movement (Liquidity Gaps): Small effort for a big result. This confirms the “ghost town” effect. It indicates a lack of opposition (No Supply or No Demand), often signaling a manipulated move in a thin market.

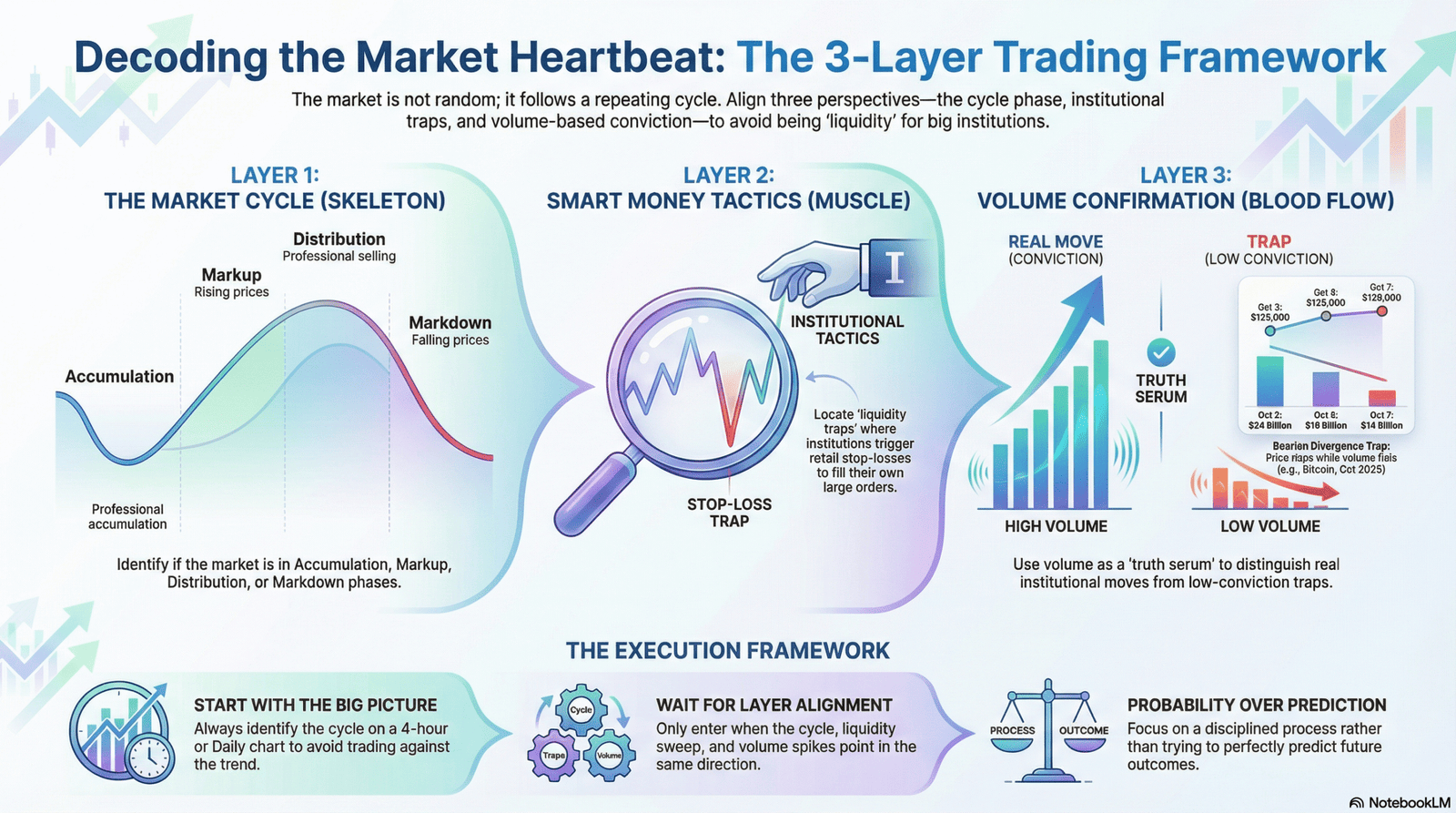

Mapping the Market Cycle

These micro-mechanics flow into the four phases of the Wyckoff market cycle. Your only job is to identify which phase we are in so you don’t end up as the “exit liquidity”:

1. Accumulation: Smart money quietly buys from “weak hands.” You will see high volume on down moves, but the price fails to make new lows. This is the physical signature of institutional absorption.

2. Markup: Demand dominates the tape. Pullbacks are shallow and occur on low volume, while breakouts follow through with conviction.

3. Distribution: Smart money unloads to the public. You’ll see strong up-bars on big volume, but no follow-through. Supply is overcoming demand.

4. Markdown: Supply dominates. Rallies are weak (“No Demand”) and price falls as aggressive sellers hit the bids.

Your “Market Truth” Checklist

Next time you open a chart, stop searching for “more buyers.” Instead, run through this checklist to see what the big players are actually doing:

1. Who is more aggressive? Look for who is crossing the spread and hitting the other side’s orders.

2. Think in Orders: Are these limit orders (resting supply/demand) or market orders (actual price movers)?

3. Watch Liquidity: Is the order book deep (slow moves) or thin (crazy spikes/liquidity gaps)?

4. Read Effort vs. Result: Is high volume producing a big move (dominance) or a small move (absorption)?

5. Identify the Cycle: Are we in accumulation, markup, distribution, or markdown?

Stop chasing every green candle. Once you start seeing the war between aggressive and passive money, you’ll stop trading against the smart money and start trading with them.