Options trading is a powerful tool for investors looking to manage risk and enhance returns. Among the various strategies available, credit spreads and debit spreads are widely used. However, despite their popularity, these strategies are often misunderstood, leading to costly mistakes. Let’s break down some common misconceptions regarding the differences between option credit spreads and option debit spreads.

Misconception 1: Credit Spreads Are Always Better Than Debit Spreads

Many traders believe that credit spreads are superior to debit spreads because they provide upfront income. While it’s true that credit spreads allow traders to collect a premium at the onset of the trade that does not make them better than a debit spread.

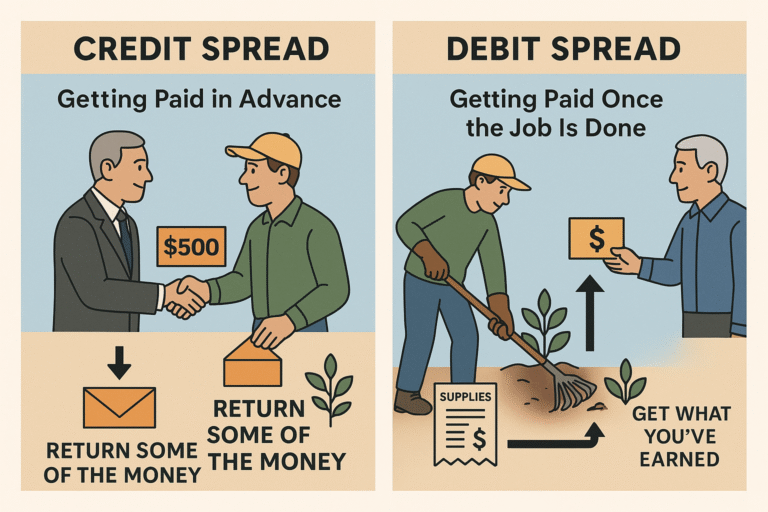

With credit spreads in a sense you are borrowing money from the markets. Let’s say you have a $5.00 wide spread and you collect $2.00 in credit. That might seem great on the surface but the broker is still going to hold out $300 in margin from your account for that trade and if the trade does not work out you will give back some or all of that credit.

On the other hand with debit spreads there is a sense that you lend money to the markets. For the same spread but done as a debit you pay the $3.00 upfront in order for the possibility of getting $5.00 back if the spread is fully profitable. In reality the cost to your account for both trades is the same $3.00 per contract or $300 total cost and the profit potential is the same $2.00 per contract or $200. So in reality the cost of the trade and the potential profit is the same whether it is done as a debit or credit spread.

Here is a video that explains the idea of lending and borrowing money illustration above.

Another common misconception is that credit spreads have an inherent advantage when volatility is high and benefit from Theta decay, yet in reality the cost of the comparable trades will be the same in times of high or low volatility and Theta decay is similar for both debit and credit spreads due to the very nature of both buying and selling an option.

Simply put there is no inherent advantage to either strategy unless there is some type of skew in option premium that makes one slightly more advantageous.

Misconception 2: Credit Spreads Are Risk-Free Because They Offer Upfront Premium

A common misunderstanding is that credit spreads provide “free money” when traders collect a premium. In reality, credit spreads come with risk. If the underlying asset moves unfavorably, the trader could incur a maximum loss, which is typically the difference between the strike prices minus the credit received.

Debit spreads also are defined risk trades so choosing one or another is more of a personal preference and not because of some mythical advantage that credit spreads have.

Misconception 3: Debit Spreads Are Always More Expensive Than Credit Spreads

Some traders assume that debit spreads are costly because they require an upfront investment, whereas credit spreads appear more affordable. However, cost alone doesn’t determine a trade’s value and the cost for a similar credit or debit spread will be virtually the same when one considers the margin withheld when a credit spread is placed. That amount will be close to the same as the initial cost of a debit spread.

Debit spreads can be structured to maximize profitability with minimal capital, and credit spreads can lead to large losses if improperly executed. Evaluating the risk-reward ratio is crucial when selecting a strategy rather than focusing solely on cost or if a spread is a credit or debit.

Misconception 4: Time Decay Only Benefits Credit Spreads

While it’s true that credit spreads benefit from time decay (since the goal is for the sold option to expire worthless), many traders fail to recognize that debit spreads can also leverage time decay under certain conditions. For example, if a debit spread consists of options closer to expiration and the underlying moves in favor of the trade, the value of the spread can increase even with limited time remaining and the spread can reach full profitability in a short amount of time.

Understanding how theta (time decay) impacts both strategies ensures traders make informed decisions rather than blindly assuming one is superior to the other. One key aspect to keep in mind is that both types of option spreads will not realize full profitability until they get close to expiration or get deep ITM (for debit spreads) or OTM (for credit spreads).

Misconception 5: Debit Spreads Require Large Price Movements to Be Profitable

Another common fallacy is that debit spreads need dramatic price shifts to generate profits. While it is true that debit spreads are directional bets, they can be structured with minimal movement requirements. By carefully selecting strike prices, traders can optimize debit spreads to profit from moderate moves rather than extreme price action.

Misconception 6: Credit spreads Are For Traders Wanting Income and Debit Spreads Are for Traders Wanting to Speculate on Price Movement

You will find many trading education programs that teach you how to use Credit Spreads to generate weekly or monthly income yet once you understand how option spreads really work you will realize you can also use debit spreads for generating income.

Conclusion

Credit spreads and debit spreads are both valuable trading strategies, but misconceptions often lead traders astray. Rather than favoring one strategy over the other based on myths, traders should analyze market conditions, risk tolerance, and financial goals before making decisions. Mastering these spreads requires an understanding of factors such as time decay, volatility, and strike price selection.

One often overlooked advantage that debit spreads have over credit spreads is the risk of early assignment. Based on their structure if the short strike of a debit spread is assigned early the long side can be exercised early and you will have a fully profitable trade. On the other hand if the short strike on a credit spread is exercised early you will have to decide if you will exercise the long option resulting in a losing trade or keep the long option and hope it makes up some of the loss from the short option.

Whether you’re an options trader looking for income or aiming to capitalize on price movements, knowing the realities of credit and debit spreads will help you avoid costly mistakes and trade with confidence.