Dispelling The Myth With An UNH Trade

In a recent post I addressed one of the most common misconceptions about if there is any real advantage of credit spreads over debit spreads even when implied volatility is high. Here I am going to share another example for consideration and which I believe indicates that debit spreads might be a better option than credit spreads, contrary to what is taught by many options courses and education firms.

This trade was on United Health (UNH), which has been in a strong downtrend and was at very high volatility due to recent news events. At the time these two trades were setup the implied volatility was 98.27% which is about as high as it can be. If one followed the traditional thinking or learned from or listened to many of the trading education companies and trading gurus online, you should sell credit spreads when volatility is high. The conventual wisdom and common teaching is that selling credit spreads in times of high volatility gives you an advantage. However as this example and the previous one on LEN show this is simply not true.

Again for this example, I did two different trades using the same strikes, same days to expiration and basically the same risk profile and while one might have expected the credit spread to be the better trade based on common teachings, it was actually the debit spread that offered the better risk to reward and worked out the best by reaching maximum profit the quickest.

To begin with let’s look at the chart of UNH at the time of the trade.

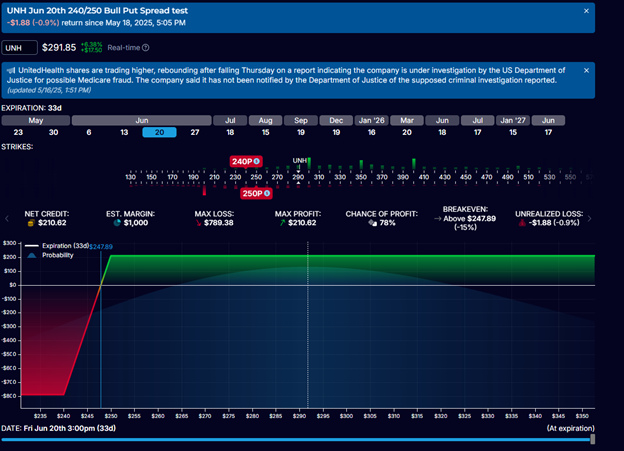

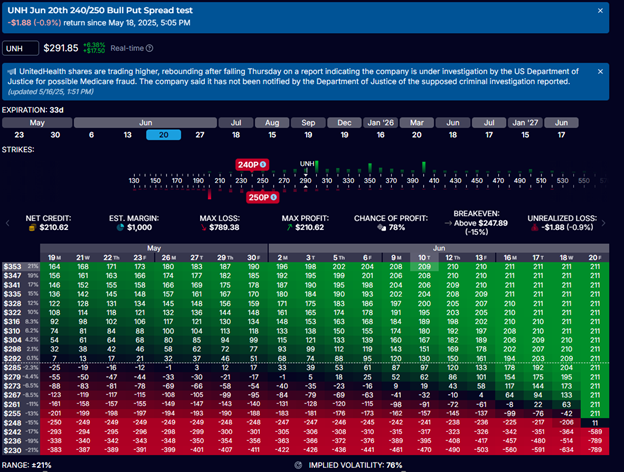

Trade # One: A Bull Put Credit Spread

This Bull Put Credit spread was set up to have a 78% probability of profit. It was a ten dollar wide spread that brought in a credit of $210. The max loss on the trade was $789.38 which was the buying power needed to place this trade. It had 33 days to expiration and would yield a rate of return of about 27% if held for max profit. Because it was an out of the money (OTM) spread UNH could drop around 15% and the trade could still be profitable. Since UNH had seemed to find an area of demand it appeared to be a high probability trade. The question though is it the best trade?

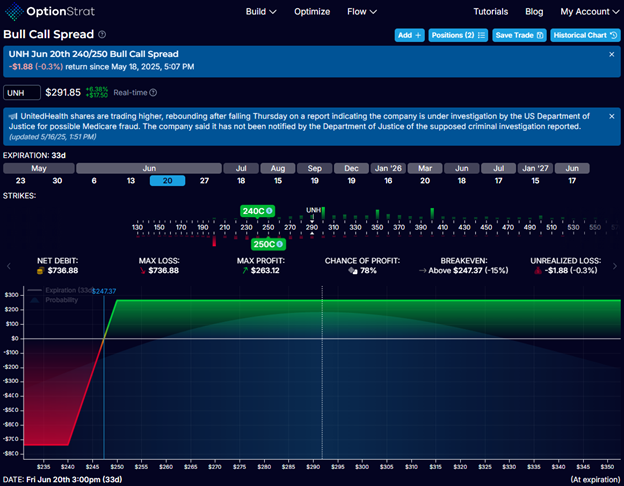

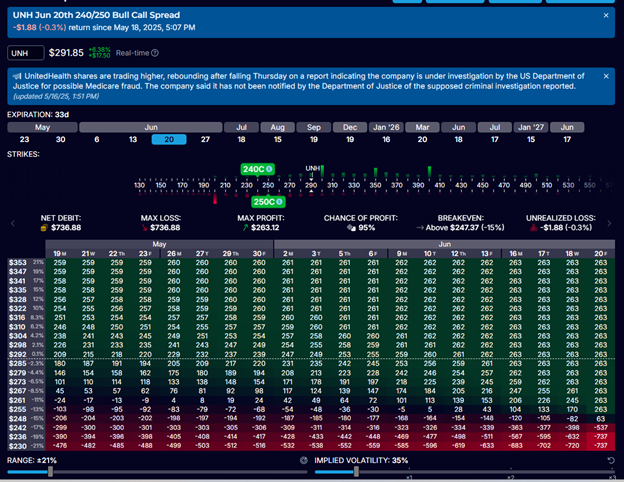

Trade # Two: A Bull Call Debit Spread

For comparison I also did a Bull Call Debit Spread on UNH using the same strike prices, spread width and expiration date. The probability of profit on this trade was the same 78% as the Credit Spread but the max risk of the trade was slightly lower at $736.88 which meant that the max profit on the trade was $263.12 which was considerably higher than the credit spread. The breakeven point was the same meaning UNH could drop 15% and the spread would still be profitable. The real difference in the two trades is that because of the lower cost and greater profit potential the debit spread could produce a significantly higher rate of return of around 36%, which was an additional 9% over the credit spread if both were held for max profit.

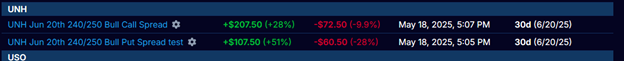

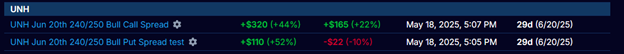

The next day after entering the trade UNH gapped up and both trades were quickly profitable but the Bull Call debit spread was much more profitable than the Bull Put Credit Spread.

Two more days went by and the same story again with the debit spread outperforming the credit spread.

The difference between the profitability of the two spreads continued to increase until the Bull Call Debit Spread was fully profitable while the Bull Put Credit Spread had only reached 50% of its max profit potential.

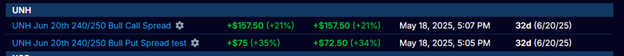

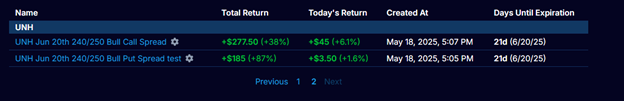

The Final Profit and Loss Graphs For The Trades

At this time we were only twelve days into the trade and the Bull Call debit spread was at full profit so both trades were closed out.

The debit spread has reached 100% profit while the credit spread was at 87% of max profit. Once again the Debit Spread out performed the Credit Spread contrary to what many people believe and teach.

* As a final note the strong move up after the trades were opened likely benefited the debit spread more than the credit spread. Had UNH continued sidewise or pulled back the debit spread would not have reached full profitability as quickly.