Why the Best Traders Are Actually the Best Losers: 5 Counter-Intuitive Truths About the Market

1. The Beach Fantasy vs. The Reality of the “Wrong Game”

Most participants enter the market fueled by a specific, manufactured fantasy: effortless daily profits, the dissolution of the 9-to-5 grind, and the ubiquitous image of the laptop on a remote beach. This dream is built on a lethal misconception: that professional success is synonymous with a high win rate.

In reality, transitioning from labor-based income to risk-based equity requires an uncomfortable admission: you will lose, and you will do so with a non-negotiable statistical certainty. The market is not “rigged,” and you aren’t necessarily lacking a “magical” indicator. Most fail because they are playing the wrong game. Professional trading is not a contest of who can be “right” most often; it is a clinical exercise in knowing how to lose correctly to survive long enough for a mathematical edge to manifest.

2. Trading is the Game of Losing Small

In the retail space, the amateur’s primary objective is to predict the future. They operate as failed fortune tellers. The professional strategist, however, has undergone a fundamental cognitive shift. We do not seek to be “right”; we seek to be systematic.

While the novice is obsessed with the outcome of the next five minutes, the professional is obsessed with managing risk in the present. We treat losses as a standard “cost of doing business”—no different than a restaurant owner views the cost of spoiled ingredients.

“My job isn’t to predict the future my job is to manage risk in the present.”

Long-term survival depends on the ability to remain emotionally detached from the outcome of any single trade. If you cannot view a loss as a planned, boring, and necessary event, you are not trading; you are gambling with your survival.

3. Your Ego is the Biggest Threat to Your Account

The most dangerous psychological behavior in this industry is “negotiating with reality.” This manifests as refusing to close a sub-optimal position, moving stop-losses further away to “give it room,” or waiting for a “wick” to return to break-even. This is the ego attempting to avoid the “pain” of being wrong.

This behavior is exacerbated by the Social Media Illusion. When your feed is flooded with screenshots of “+300% in one week” and “perfect equity curves,” your brain begins to believe that “real” traders never lose. This is a lie. Professional P&L is often messy, characterized by long periods of sideways chop and frequent, small drawdowns.

“Your account doesn’t care about your ego it only cares about math.”

The market does not care about your need for validation. To survive, you must implement rigid rules that prevent your ego from hijacking your execution during moments of high variance.

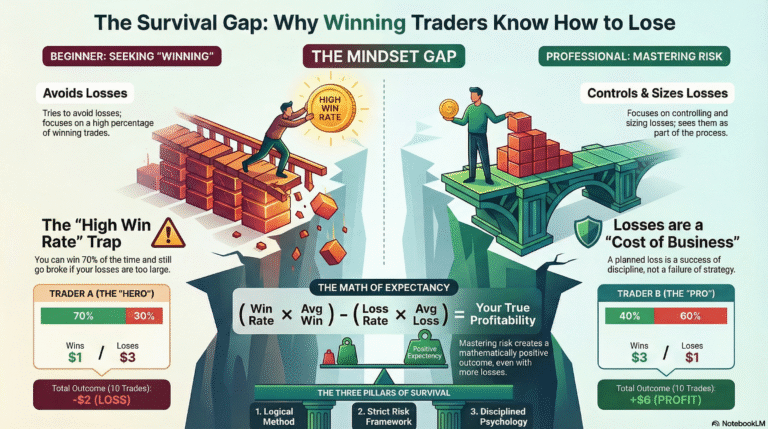

4. The High Win-Rate Trap: Why 70% Accuracy Can Still Go Broke

A high win rate is a vanity metric. To determine if a strategy is viable, a strategist looks only at Expectancy—the “Holy Grail” of systematic trading.

The Formula: Expectancy = (Win Rate x Average Win) - (Loss Rate x Average Loss)

To understand this, we must define the “R” Multiple. One “R” represents your initial unit of risk (e.g., if you risk $100 to make $300, you are seeking a 3R return).

| Feature | Trader A (The “Hero”) | Trader B (The Professional) |

|---|---|---|

| Win Rate | 70% | 40% |

| Average Win | +1R | +3R |

| Average Loss | -3R | -1R |

| 10-Trade Result | (7 x 1R) – (3 x 3R) | (4 x 3R) – (6 x 1R) |

| Net Result | -2R (Net Loss) | +6R (Net Profit) |

Trader A is “picking up pennies in front of a steamroller.” They look like a genius until one or two “heroic” stands against the market wipe out weeks of gains. Trader B understands that losing 60% of the time is irrelevant if they “lose well.” They are mathematically profitable because they prioritize the ratio of their wins to their losses over the frequency of being right.

5. The Three-Year Trap and the Illusion of Knowledge

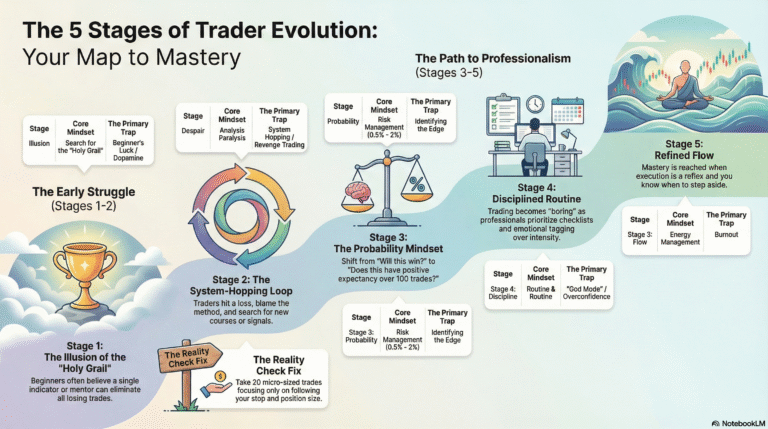

Most traders follow a predictable, three-stage path toward failure:

• Year 1: Emotional Trading. Execution is driven by hype, social media tips, and news. There is no plan, only guesses.

• Year 2: Illusion of Knowledge. This is the most dangerous stage. The trader adopts “fancy terms” and clutters their charts with 10 different tools and indicators. They feel smarter, but because they lack a mathematical edge, their results remain random.

• Year 3: Blaming Mindset. The trader blames “psychology” for their lack of success. While mindset is vital, it cannot rescue a system that is mathematically insolvent.

To exit this trap, you must master the Three Pillars of Trading:

1. Method: A clear, logical, testable system for entries and exits.

2. Risk: A strict framework for losses per trade, day, and month.

3. Psychology: The discipline to execute the math without interference.

Failure is a mathematical certainty if you ignore these. Great Method + Bad Risk = Blowup. Great Risk + No Method = Random Gambling.

6. Training Your “Losing Muscle” with Practical Exercises

Systematic discipline is a muscle that must be trained. Use these professional exercises to rewire your response to risk:

• Predefine the Loss: Before clicking “buy” or “sell,” state out loud: “If I am wrong, I am losing [X] dollars.” Force your brain to accept the liability before the trade begins.

• The 20-Trade Challenge: Commit to 20 trades using a single setup. The goal is compliance, not profit. If you break a rule on trade #19, the challenge resets to zero. This trains you to think in a series of outcomes rather than individual events.

• Emotion Journaling: After every trade, log your emotional state. Did your ego try to “negotiate” the stop-loss? Identifying where the “Math” was hijacked by “Feeling” is the only way to fix your execution.

• Celebrate “Good Losses”: A “good loss” is any trade that hits your stop-loss exactly as planned while following your system. Mark these as successes. You are teaching your brain that losing correctly is the foundation of winning long-term.

Conclusion: The Professional Path Forward

Professional trading is not dramatic, flashy, or heroic. It is a boring, repetitive process of executing validated setups and respecting risk limits with mechanical precision.

Success does not belong to the genius who attempts to call every market top or bottom. It belongs to the strategist who is still standing after 100 losses because they mastered the art of losing small.

The final question remains: Are you trading like the gambler, or are you the casino? The casino does not care about a single losing hand; it remains profitable because it protects its edge over 10,000 hands. Structure your risk so that you can do the same.