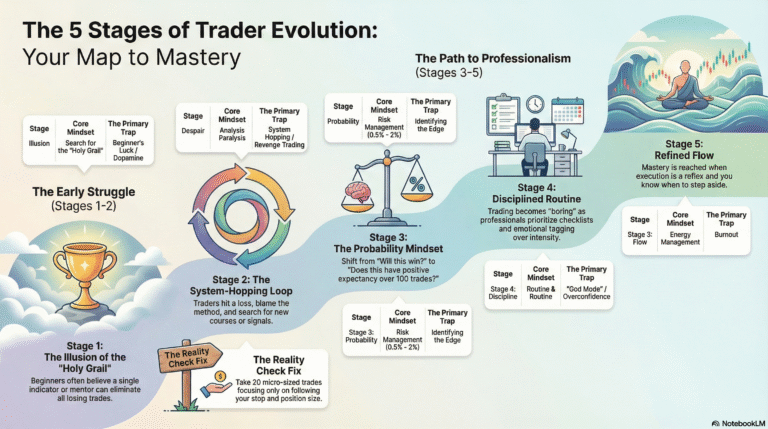

Why Most Traders Fail: The 5 Stages of the Professional Evolution

1. The Hook: The Map You Didn’t Know You Needed

Most traders are trying to climb a mountain without a map. They scramble over the terrain, burning through psychological capital and account equity, unaware of where they are on the journey or what specific traps lie just around the bend. This is why you see traders repeating the same errors for five years straight despite “trying hard.” Effort without direction is just a slow way to go broke.

To reach the summit of consistent profitability, you must understand that trading is not a get-rich-quick scheme; it is a professional evolution. By identifying which of the five stages you are currently in, you can stop the cycle of frustration and follow the definitive roadmap from amateur to professional.

——————————————————————————–

2. Stage 1: The Illusion of the “Holy Grail”

Stage 1 is the most dangerous era of your career: the era of Unconscious Incompetence. You don’t know that you don’t know. The average trader enters the market with a beautiful but toxic belief that success is simply a matter of finding the right “secret”—the perfect indicator, the ultimate mentor, or a “can’t-miss” setup.

This is the “Holy Grail Syndrome.” The greatest threat here is actually beginner’s luck. A few random wins in a trending market trigger a dopamine hit, and the brain learns a catastrophic lesson: that high risk equals being “correct.” Whether it is the moonshot mentality of Crypto or the leverage traps of Forex, the trader eventually hits a drawdown painful enough to serve as a reality check.

“If you believe one indicator, one mentor, or one ‘perfect entry’ will remove losing trades… that’s Stage 1.”

Action Item: The Consistency Foundation Take 20 trades at micro size with a fixed stop and fixed risk. Your only goal is to verify execution: Did you follow your stop and your size? Ignore the win/loss outcome entirely; you are training your brain to prioritize process over PnL.

——————————————————————————–

3. Stage 2: The Knowledge Trap and System Hopping

Stage 2 begins when you finally admit you lack a plan. However, the reaction is usually “Despair,” leading to a cycle of system hopping. You run a strategy for three days, hit a normal losing streak, and immediately conclude the method is “broken” before buying a new course.

This results in Analysis Paralysis—too much fragmented knowledge but zero ability to execute. Many at this stage also develop “signal dependency.” They follow a guru’s calls because losing feels less personal when someone else is at fault; it acts as a psychological shield that prevents true growth. You don’t lack knowledge here; you lack structure.

Action Item: The 30-Day Input Freeze To escape the loop, you must limit your variables. For the next 30 days, commit to the following:

• One Setup: Choose a single, high-probability entry strategy.

• One Timeframe: Stick to a single chart interval to learn its rhythm.

• One Trading Window: Trade only during a specific 2-3 hour block.

• Journaling: Record execution mistakes and “emotional noise” rather than focusing on the dollar amount.

——————————————————————————–

4. Stage 3: The “Aha” Moment – Prediction vs. Probability

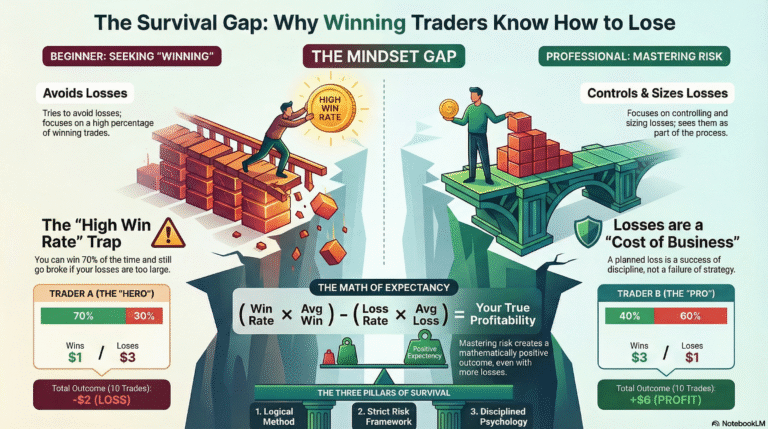

In Stage 3, the “Aha” moment arrives: trading is not a prediction game; it is a business of probability management. You stop asking “Will this trade win?” and start asking “Does this setup have a positive expectancy over 100 iterations?”

This stage requires detaching your identity from trade outcomes. A single win doesn’t make you a genius, and a single loss doesn’t make you a failure. You define an “edge” using an IF-THEN mindset: IF conditions A, B, and C happen, THEN I enter with risk X.

The Mathematical Reality of Risk Pros understand the “Math of Ruin” better than anyone. If you lose 50% of your account, you don’t need a 50% gain to recover; you need a 100% gain just to get back to breakeven. This is why risk management is a mathematical necessity, not a suggestion.

“In trading, you don’t die from one trade. You die from a sequence of trades.”

In this stage, you view a Stop Loss as Insurance. It isn’t a sign that you were “wrong”—it is a small fee you pay to stay in the game and protect your equity curve.

——————————————————————————–

5. Stage 4: The Pursuit of the “Boring” Routine

By Stage 4, you are consistently profitable, but it still feels like “work.” You have to fight the impulse to deviate from the plan. Paradoxically, professional trading starts to feel “boring” because it is rooted in a strict, repetitive routine:

• Pre-market: Reviewing volatility, news calendars, and key levels.

• Execution: Only engaging when the checklist is fully cleared.

• Post-session: Journaling not just PnL, but MAE (Maximum Adverse Excursion) and MFE (Maximum Favorable Excursion).

The primary threat here is the “Boss Fight” known as God Mode. After a winning streak, overconfidence sets in. You might increase size or loosen rules “just a little.” Professionals don’t “die” because they lack knowledge; they blow up because they let intensity override consistency.

——————————————————————————–

6. Stage 5: The Flow State and the Power of “Not Trading”

Stage 5 is the “Refined” stage. After thousands of repetitions, your decisions become reflexive. You recognize price rhythm and liquidity locations intuitively. This “Flow” isn’t a magical feeling; it is the result of thousands of hours of deliberate practice.

At this peak, you realize trading is an energy management game. If the market conditions don’t fit your edge, you walk away. Professionalism is defined as much by the trades you don’t take as the ones you do.

This stage is often reached faster through Time Compression. In 24/7 markets like Crypto, the sheer volume of cycles allows you to hit the “10,000-hour rule” in a shorter calendar window. However, the trap is trying to learn everything at once. Reaching Stage 5 requires picking one market and mastering its specific volatility before expanding.

——————————————————————————–

7. Conclusion: Where Do You Stand?

The path to the professional level is a clear evolution:

1. Illusion: Chasing the “Holy Grail.”

2. Despair: System hopping and signal dependency.

3. Probability: Mastering expectancy and the math of risk.

4. Routine: Prioritizing boring consistency over the “God Mode” impulse.

5. Flow: Refined reflexes and the wisdom to step aside.

Be honest: where are you on this map? Once you identify your location, stop looking for secrets and start building the structure required for the next stage.

Stay disciplined.