Bollinger Bands were created by John Bollinger in the 1980s, and are one of the most versatile and widely used volatility indicators in technical analysis.

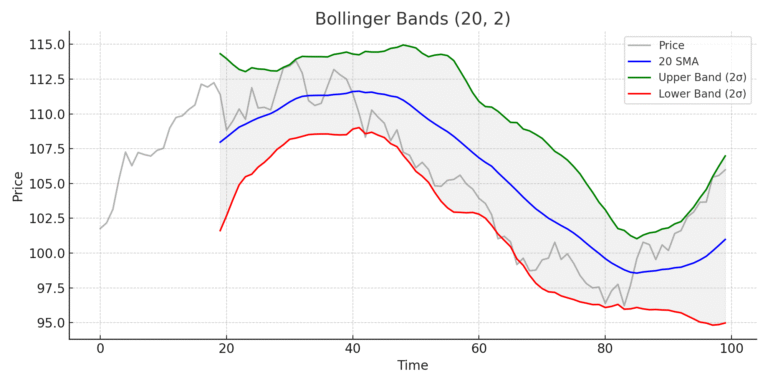

They consist of three components:

- A moving average (typically 20-period SMA)

- An upper band = MA + (2 * standard deviation)

- A lower band = MA – (2 * standard deviation)

The bands expand and contract based on market volatility. Bollinger Bands are not buy or sell signals by themselves, but a framework for judging price action.

John Bollinger’s Core Principles:

- Use Bollinger Bands with price action, volume, and confirmation indicators.

- Band “tags” are not reversal signals by themselves.

- Price can “walk the band” in strong trends.

- Look for squeezes (low volatility) followed by breakouts.

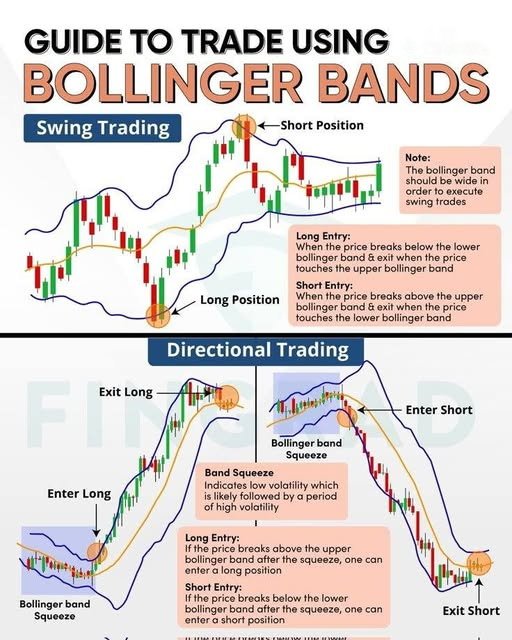

Key Bollinger Band Strategies:

- The Squeeze

- Bands contract during low volatility.

- A breakout from the squeeze often leads to strong directional moves.

- Confirm with volume surge or trend indicator (e.g., MACD).

- Riding the Band

- In trending markets, price may hug the upper or lower band.

- In an uptrend: buy near middle band (20-SMA), exit near upper band.

- In a downtrend: short near middle band, cover near lower band.

- Double Bottom with Band Tag

- First low touches lower band, second low holds above band.

- Used as a bullish reversal setup, especially when RSI confirms divergence.

- Reversal on Exhaustion

- Price pierces upper/lower band with high volume and reversal candlestick.

- Watch for pin bars or engulfing candles.

- Best when combined with overbought/oversold indicators.

John Bollinger’s Favorite Confirmation Tools:

- Relative Strength Index (RSI)

- Volume indicators (e.g., On-Balance Volume)

- Pattern recognition (double bottoms, W-bottoms)

Common Misconceptions:

- Bollinger Bands are NOT static buy/sell zones.

- Price crossing a band does NOT mean automatic reversal.

- Bands must be interpreted in context with trend and volatility.

Recommended Settings:

- 20-period SMA

- 2 standard deviations

- For faster reaction: use 10-period SMA with 1.5 std dev

- For smoother signals: 50 SMA with 2.5 std dev (used in longer timeframes)

Bollinger Bands work best when combined with other signals in a rule-based system. They are a volatility lens to help traders identify breakout conditions, mean-reverting moves, and continuation patterns with clarity.

Visual Example: Bollinger Bands