Correcting a Common Misconception on Vertical Spreads

When I was taught options they taught us that when volatility is high or inflated you should sell credit spreads and when volatility was low you should use debit spreads. This type of teaching is pretty common on the internet with many trading education courses and services. In fact I might go so far as to say the idea that selling credit spreads inherently have an advantage over debit spreads no matter what the volatility is one of the most common misconceptions about trading vertical spreads there is. Similarly many teach that selling credit spreads is the way to generate income trading options while ignoring the fact that debit spreads can achieve the same goal.

The purpose of this example of a real trade using both a Bull Put Spread (Credit Spread) and a Bull Call Spread (Debit Spread) is to show that in reality there is little difference between the two strategies when they are setup with similar risk to reward and profit potential even when option volatility is very high.

The stock in this example is Lennar (LEN) and it was getting close to earnings so the volatility was high. Using the OTA volatility gauge that shows when options are “inflated” this stock had an IV rank of 5 which means it should be traded using credit spreads per the commonly accepted teaching. The actual implied volatility was 51.31% which gave it a rank of 90.19% per Barchart. I chose this stock simply because it was one of the highest IV% rankings at the time of the trade and had liquid options.

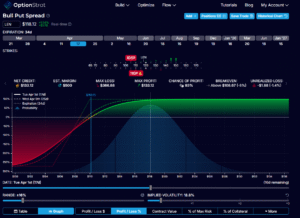

The first trade I put on was a Bull Put Credit Spread where the short strike was about a 30 delta with 33 days to expiration. This generated a net credit of $133.12 on a $5 wide spread with the breakeven point at $108.67. The spread required $366.68 in buying power and had a probability of profit of 70%. If fully profitable the trade would produce a 36% rate of return in 33 days.

The second trade I put on was a Bull Call Debit Spread using the same strike prices and same days to expiration. The debit spread resulted in a cost of $331.88 (slightly less than the credit spread) and had a max profit of $168.12 (slightly more than the credit spread). The probability of profit was 71% and the break even was $108.32 which was just slightly lower than the breakeven mark of the credit spread.

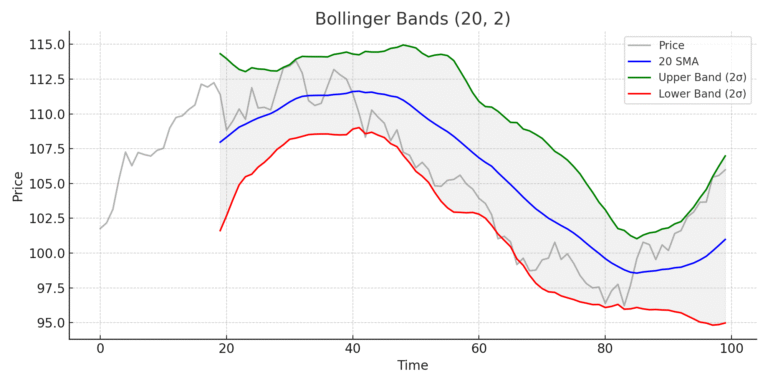

One of the reasons that selling credit spreads in a time of high volatility is supposed to work in your favor is due to the likelihood of volatility going down which is supposed to benefit credit spreads. The second advantage that credit spreads are said to have is benefiting from theta decay. However when I modeled that using the OptionStrat platform that did not necessarily hold true as seen in the next two profit and loss graphs.

These profit and loss graphs show what happens after about 1/2 of the time has gone by and the volatility has dropped by 20 points.

As these two risk graphs show the Debit spread actually has a higher profit level after the time decay and drop in volatility has happened. So, in theory it looks like Market Rebellion is correct and that neither trade gives you a significant edge of the other one. I found this to be interesting having been taught to switch strategies based on option volatility.

Final trade update

The trade was entered on March 13, 2025 and now we are half-way through the trade timeframe. Over this time the stock has gone through earnings, so volatility has dropped from 51.31% to 23.4% and 17 days of theta decay have taken place. The price gapped down on earnings and then basically went sidewise since then. At this point in time our Bull Call Spread is significantly more profitable than the Bull Put Spread. This seems to contradict what OTA and others teach about how you should use credit spreads in times of higher volatility.

Here is a copy of the candlestick chart of LEN at that time.

Here are the risk profiles of both trades.

Understanding the functional differences between credit and debit spreads lays the groundwork for recognizing how they can be interchangeably employed within various trading strategies, depending on prevailing market conditions and objectives of the trader.

Risk to Reward Assessment in Credit and Debit Spreads

In trading, risk to reward assessment is instrumental in determining the viability of various strategies, including credit and debit spreads. Both approaches, while structurally different, can result in comparable risk to reward ratios. A credit spread involves selling an option and buying another option on the same underlying asset, resulting in an immediate cash inflow. Conversely, a debit spread entails purchasing an option while simultaneously selling another, necessitating an initial cash outlay. Despite these differences, the potential outcomes of both strategies can yield similar risk to reward profiles, making it essential for traders to understand their nuances.