Introduction to Options Trading

Options trading has become increasingly popular among investors who seek to diversify their portfolios and enhance returns. At its core, options are financial derivatives that provide the buyer with the right, but not the obligation, to buy or sell an underlying asset at a predetermined price, known as the strike price, before a specific expiration date. This unique feature of options allows traders to speculate on the future price movements of various assets, including stocks, indexes, and commodities, without directly investing in the underlying asset.

To be successful trading options the first step is to understand the two main types of options: calls and puts. A call option grants the holder the right to purchase the underlying asset at the strike price, making it a potentially beneficial tool when expecting the asset’s price to rise. Conversely, a put option bestows the right to sell the underlying asset at the strike price, serving as a strategic device for those anticipating a decline in asset prices. Each type of option comes with its own set of strategies and risks, which can appeal to a wide range of trading styles and market outlooks.

One of the primary reasons traders engage in options trading is the flexibility it offers. Investors can leverage their positions, which means they can control larger amounts of the underlying asset with a relatively smaller investment. This can result in amplified returns, but it also introduces heightened risks, warranting a thorough understanding of the market and the specific options being traded. As we delve further into the complexities of options trading, it is essential to grasp these foundational concepts to develop effective strategies and make informed investment decisions.

Understanding Calls and Puts

There are two fundamental types of options: call options and put options and as an option trader you be either a buyer or a seller.

Understanding how these options gain or lose value as the underlying stock moves up or down is the foundational building block to learning to trade options. The new trader should be come very familiar with

A call option is a contract that grants the holder the right, but not the obligation, to purchase a specified amount of an underlying asset at a predetermined price, known as the strike price, within a designated time frame. This mechanism allows traders to speculate on the price appreciation of the asset without actually owning it outright. For instance, if an investor purchases a call option for a stock currently trading at $50 with a strike price of $55, they can benefit if the price surpasses $55 prior to the option’s expiration. Should the stock rise to $60, the investor stands to gain significantly.

On the other hand, put options function as the converse of call options. A put option gives the holder the right, again with no obligation, to sell a specific amount of an underlying asset at a predetermined strike price within a specified time period. This allows investors to hedge against potential declines in the asset’s value or to profit from bearish market conditions. For instance, if an investor buys a put option for a stock trading at $50 with a strike price of $45, they can sell the stock at $45 even if the market price drops to $40, thus mitigating losses. The strategic use of put options can be particularly beneficial in volatile markets where asset prices may fluctuate drastically.

Both call and put options serve as integral components of diverse trading strategies. By leveraging the rights these options confer, investors can tailor their approach depending on market conditions, personal risk tolerance, and investment objectives. Through understanding calls and puts, traders can make informed decisions, utilizing the full potential of options in their trading endeavors.

The Importance of Options Pricing

Options pricing is a fundamental aspect that every trader must grasp in order to navigate the dynamic landscape of options trading effectively. The valuation of an options contract is influenced by three primary components: intrinsic value, time value, and volatility. Each of these factors plays a crucial role in determining the premium that traders must pay or receive when entering into an options contract.

Intrinsic value is the simplest of the three components. It refers to the inherent worth of an option if it were to be exercised immediately. For call options, the intrinsic value is calculated by subtracting the strike price from the current price of the underlying asset. Conversely, for put options, it is derived by taking the difference between the strike price and the underlying asset’s current price. If these values yield a negative outcome, the intrinsic value is considered zero. This component is essential because it reflects the immediate profit potential of the option.

Time value, on the other hand, considers the duration until the option’s expiration. Options lose value as they approach their expiration date, a phenomenon known as time decay. This means that the further an option is from expiration, the more time value it possesses. Traders must account for this when calculating potential returns, as options with more time until expiration typically command higher premiums due to the increased likelihood of price movement in favor of the position.

Lastly, volatility, particularly implied volatility, is a measure of the expected price fluctuations of the underlying asset. Higher volatility generally increases the option’s premium due to the greater potential for price movements, which can result in a profitable trade. Understanding how these factors interrelate enables traders to make informed decisions about whether to buy or sell options, ultimately enhancing strategic planning in their trading endeavors.

Advantages of Using Options Spreads

Options spreads represent a strategic approach in options trading that combines multiple contracts to maximize advantages while mitigating risks. One of the primary benefits of using options spreads lies in their ability to manage risk effectively. By simultaneously buying and selling options at different strike prices or expiration dates, traders can create a protective net that reduces exposure to adverse market movements. This characteristic makes options spreads particularly appealing for risk-averse investors seeking to safeguard their capital while still engaging in potential profit-building opportunities.

In addition to risk management, options spreads can enhance profit potential. When implemented correctly, these strategies can profit in various market conditions. For instance, a bull spread aims to capitalize on rising prices, while a bear spread is designed for declining market scenarios. This versatility allows traders to benefit from different market dynamics, thereby optimizing their overall profitability without taking on excessive risk. In many cases, the potential reward is structured to be greater than the risk, which is a compelling reason for traders to consider spread strategies.

Moreover, options spreads often require a lower capital outlay compared to outright purchasing options. By utilizing spreads, traders can operate with reduced margin requirements, allowing them to allocate their funds more efficiently. This reduced capital requirement does not compromise potential gains; rather, it allows traders to diversify their options holdings across various strategies. Additionally, the structured approach of options spreads enables traders to set specific risk-reward parameters, providing clarity in decision-making. Overall, options spreads furnish traders with a robust framework for navigating the complexities of the options market while maximizing the potential for profitable trades.

Technical Analysis for Options Trading

Technical analysis serves as a vital component in the realm of options trading, offering traders valuable insights into potential market movements. At its core, technical analysis involves the study of past market data, primarily price and volume, to forecast future price action. For options traders, this forecasting is crucial in identifying optimal entry and exit points for their trades.

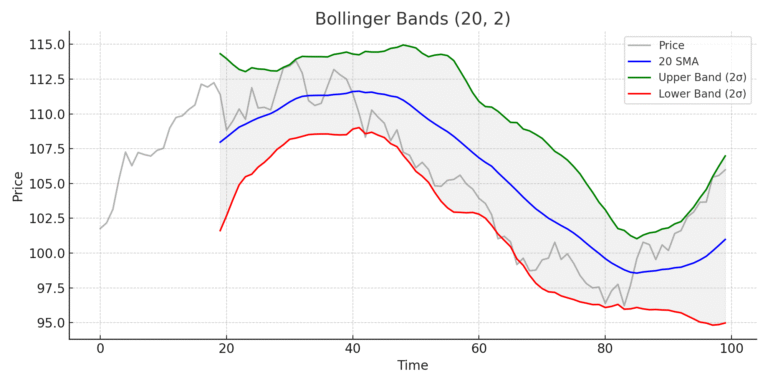

One of the most essential tools in technical analysis is the use of indicators. Popular indicators such as Moving Averages, Relative Strength Index (RSI), and Bollinger Bands provide traders with a clearer picture of market trends and momentum. Moving Averages help smooth out price data over a specific timeframe, allowing traders to identify underlying trends more effectively. In contrast, the RSI can signal whether an asset is overbought or oversold, helping traders to gauge potential reversal points.

Chart patterns also play an integral role in technical analysis for options trading. Familiar patterns, including Head and Shoulders, Double Tops and Bottoms, and Flags, can provide traders with insights into potential price movements. Recognizing these patterns enables traders to make educated predictions about market behavior. For example, a Head and Shoulders pattern may indicate a reversal in market direction, thus alerting traders to consider specific options strategies that align with the anticipated movement.

Moreover, combining multiple indicators and chart patterns can enhance the accuracy of predictions. For instance, if a trader observes a breakout from a significant resistance level, supported by increased trading volume and a bullish RSI, this confluence of signals may strengthen the argument for entering a call option. However, it is essential to remain cautious, as no analysis is foolproof. Proper risk management should complement any technical analysis to safeguard against market volatility.

Creating a Trading Plan

Developing a structured trading plan is essential for anyone venturing into the world of options trading. A well-defined plan serves as a roadmap that guides traders in their decision-making processes and helps them stay disciplined throughout their trading journey. The first step in creating a trading plan is to set clear, attainable goals. These goals could include specific profit targets, the amount of capital willing to invest, or the desired number of trades per week. Clear objectives help in measuring progress and provide motivation to stick to the trading strategy.

Next, effective risk management strategies must be integrated into the trading plan. This involves defining the maximum amount of capital one is prepared to lose on any single trade, often referred to as a risk-reward ratio. Many experienced traders recommend risking only a small percentage of one’s trading capital on individual trades, typically between 1% to 2%. Using stop-loss orders can also help limit potential losses and protect capital. Understanding the volatility of the options being traded and adjusting strategies accordingly is crucial to effective risk management.

Moreover, the importance of patience and discipline cannot be overstated in the realm of options trading. Traders should prepare to endure periods of market fluctuations without deviating from their plan. The emotional swings associated with trading can lead to impulsive decisions that detract from long-term success. Establishing a routine for reviewing trades, evaluating performance, and making necessary adjustments to the trading plan can foster a disciplined approach. By adhering to a well-structured trading plan that incorporates goal setting, risk management, and emotional resilience, traders can enhance their chances of success in options trading.

Emotional and Psychological Aspects of Trading

Trading options presents not only financial challenges but also significant psychological hurdles that can impact decision-making processes. The fast-paced and often unpredictable nature of the options market can evoke a plethora of emotions, primarily fear and greed, which are the two dominant psychological factors influencing traders. Fear can manifest as anxiety about potential losses, causing traders to exit positions prematurely or avoid entering trades altogether. Conversely, greed can lead to overconfidence, prompting traders to take excessive risks in pursuit of higher returns. Understanding these emotions is crucial for developing a robust trading strategy.

To navigate the emotional landscape of options trading, traders must cultivate mental fortitude. This entails establishing a disciplined approach to trading that prioritizes rational decision-making over impulsive reactions. One effective method for developing resilience in the face of market volatility is setting clear, predetermined criteria for entering and exiting trades. By adhering to a plan, traders can mitigate emotional responses and better manage the psychological pressures that arise from market fluctuations.

Additionally, enhancing one’s emotional intelligence is vital for dealing with the stresses inherent in trading. Emotional intelligence involves recognizing and managing one’s emotions, as well as understanding the emotional states of others. By improving this skill, a trader can foster better judgment and make more informed choices under pressure. Techniques such as mindfulness and stress-reduction exercises can also aid traders in maintaining a calm and rational mindset. In conclusion, addressing the emotional and psychological aspects of trading is essential for anyone engaging in options trading. Achieving a balanced mindset allows traders to make well-considered decisions, ultimately leading to a more disciplined and effective trading experience.

Common Mistakes to Avoid in Options Trading

Options trading can often be a complex endeavor, especially for beginners. Understanding calls, puts, and various strategies is only part of the journey; recognizing common mistakes is crucial for long-term success. Novice traders frequently fall into traps that can hinder their performance and diminish potential profits. One such pitfall is over-leveraging. New traders often underestimate the risks associated with options, leading them to invest too heavily in a single position. This can result in significant losses if the market moves unfavorably.

Another typical mistake is failing to fully understand the chosen options strategy. Many beginners jump into trading without a sufficient grasp of how the particular option works, including its pricing dynamics and potential market influence. Comprehensive research and education are paramount. For example, using strategies like spreads or straddles requires a solid understanding of market movements and volatility. Without this knowledge, traders might commit to positions that do not align with their market outlook.

In addition, emotional trading is a common issue that plagues novice options traders. Many may find themselves making impulsive decisions dictated by fear or greed, rather than following a well-thought-out plan. Establishing a clear trading strategy, including defined entry and exit points, can help mitigate these emotional responses. It is also advisable to maintain a disciplined approach, emphasizing consistent evaluation of trades against preset goals to avoid deviation driven by market noise.

Finally, neglecting to adjust positions as market conditions change may lead to unfavorable outcomes. Options traders must remain vigilant and ready to manage their positions proactively. By recognizing and addressing these common mistakes, novice options traders can cultivate a more effective trading strategy, ultimately enhancing their overall performance in this challenging environment.

Conclusion and Next Steps

In conclusion, understanding options trading is a valuable skill for any investor looking to diversify their portfolio and enhance their trading strategies. Throughout this guide, we have explored the fundamental concepts of options, including calls and puts, and how they function within the financial markets. A solid grasp of these basic elements can provide a strong foundation for further study and application in real trading scenarios.

As you embark on your options trading journey, it is essential to continue expanding your knowledge. Consider leveraging various resources to deepen your understanding of the mechanics behind options. Online courses, webinars, and trading simulators are excellent tools that allow you to practice without real financial risk. Many brokerage firms also offer educational material that can help clarify more complex strategies and concepts regarding options trading.

Moreover, joining online forums or local investment clubs can facilitate discussions with both experienced traders and fellow beginners. Engaging with a community can provide valuable insights and spark conversations that enhance your knowledge of options trading. Don’t hesitate to ask questions and share your experiences; the trading community can be a wonderful resource for ongoing learning.

Ultimately, trading options requires diligent study, practice, and a willingness to adapt strategies as you gain experience. By furthering your education in options trading, you position yourself not only to navigate the intricacies of the market but also to make informed decisions that can lead to successful trading outcomes. As you continue this journey, remember that the world of options trading is ever-evolving, and remaining informed is key to achieving your financial goals.