Overview: Call Debit Spreads on Trending Stocks

Call debit spreads are directional trades designed to benefit from upward price movement while managing risk. This strategy involves buying a call and simultaneously selling a higher strike call with the same expiration. This strategy is Ideal for stocks in confirmed uptrends.

Entry Option 1: Very Conservative (Deep ITM)

- Objective: 15% return

- Delta Range: 0.75 – 0.90

- Days to Expiration: 30-45 DTE

- Spread Width: Wide enough to limit extrinsic value

- Ideal Setup: Deep ITM call bought with short leg well ITM

- Characteristics: High win rate, lower ROI

- Backtested Win Rate: ~88%

- Use when trend is strong and you want high probability, low risk trades

Entry Option 2: Moderate (ITM)

- Objective: 25-30% return

- Delta Range: 0.60 – 0.70

- Days to Expiration: 21-35 DTE

- Spread Width: Moderate (e.g., $5 wide for $2.50 debit)

- Ideal Setup: Buy slightly ITM, sell strike 1-2 levels higher

- Characteristics: Balanced risk/reward

- Backtested Win Rate: ~75%

- Use when trend is stable, and you’re willing to take slightly more risk for better returns

Entry Option 3: Aggressive (ITM to Slightly OTM)

- Objective: 50% return

- Delta Range: 0.45 – 0.55

- Days to Expiration: 14-25 DTE

- Spread Width: Tight (e.g., $3-$5 wide paying ~$1.50 debit)

- Ideal Setup: Buy ATM or slightly ITM, sell slightly OTM

- Characteristics: Higher risk, higher reward

- Backtested Win Rate: ~62%

- Use when strong breakout or momentum move is expected

Best Practices & Notes

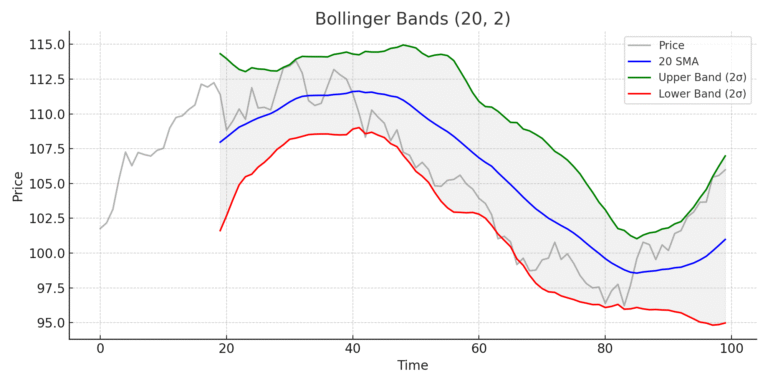

- Choose trending stocks with strong fundamentals or technicals.Use moving averages and momentum indicators for trend confirmation

- Avoid holding through earnings unless specifically part of the strategy

- Exit early when profit targets are hit (e.g., 80-90% of max gain)

- Monitor volume and open interest to ensure liquidity