“Financial markets are fractal in nature, meaning that the market prices follow patterns that exhibit similar characteristics over time.”

Benoit Mandelbrot

Although all the Greeks are important to know, it is the understanding of delta and gamma that is probably the most important and, at the same time, the least understood.

Bill Johnson -An Investor’s Guide to Understanding and Mastering Options Trading

Letting losses run is the most serious mistake made by most investors.

Benjamin Graham

Keep it simple. Simple time-tested methods that are well executed will beat fancy complicated methods every time.

Curtis Faith

It isn’t as important to buy as cheap as possible as it is to buy at the right time.

Jesse Livermore

Edges are found in the places that are the battleground between the buyers and the sellers. Your task as a trader is to find those places and wait to see who wins and who loses.

Curtis Faith

If we were to investigate the daily P&L of an emotionally intelligent trader, we would find occasions of trading actively and occasions of standing back. We would see periods of high-risk taking and periods of caution. All markets are not created equal: some bring more opportunity, some less. The self-aware trader knows when “it’s my market” and goes into opportunity-seeking mode. The same trader knows when “it’s not” my market and preserves capital.

Dr. Brett Steenbarger

Price is the only thing that pays!

Brian Shannon

Stocks never go up in price by accident–there must be large buying demand. Most of this demand comes from institutional investors, who account for more than 75% of the buying of the better quality, leading stocks.

William J. O’Neil

“Stochastics measures the momentum of price. If you visualize a rocket going up in the air – before it can turn down, it must slow down. Momentum always changes direction before price.”

George Lane, developer of the Stochastic indicator

“The 10-day EMA is my favorite indicator to determine the trend. I call it ‘red light, green light’ because trading requires you to trade on the right side of the MA to maximize the probability of profits. If the price is above the 10-day EMA, you have the green light. The market will be in a positive mood and you should think about buying. On the other hand, a price below the 10-EMA indicates a red light. The market is in a negative mood and you should think about selling.”

Marty Schwartz

In general, any performance information you receive from someone wanting to sell you signals, a black box system, a subscription, trading room, and so on should not be trusted. An excellent general rule is: don’t believe any of it.

Ken Davey

It was some time before I recognized that the desire for trading success and profits by retail (home-based) traders generates an large industry fraught with peril. As I’ve already alluded to, most of the so-called education and trading systems providers, along with many of the books on the subject are close to worthless.

Chris Wilson in his book Beat the Markets

As you are probably aware, or will no doubt find out when you begin trading, there are several free “volume” indicators, and many proprietary systems that you can buy. Whether free or paid, all have one thing in common. They have neither the capacity nor intellect to analyze the price volume relationship correctly in my view. for the simple reason, that trading is an art, not a science.

Anna Coulling

…trading and investing is like any other pursuit–the longer you stay at it the more technique you acquire, and anybody who thinks he knows of a short cut that will not involve ‘sweat of the bros’ is sadly mistaken.

Richard Wychoff

No price is too low for a bear or too high for a bull.

Unknown

The key is having more information than the other guy–then analyzing it right and using it rationally.

Warren Buffett

“Reading all the financial news and evaluating it will avail you nothing. The market may rise on bad news and go down on good news. Then where are you?”

Richard Wyckoff

There is nothing new in Wall Street. There can’t be because speculation is as old as the hills. Whatever happens in the stock market today has happened before and will happen again.

Jesse Livermore

Trading Insights

Learn strategies, techniques and tips to help you learn how to avoid pitfalls new traders face and make progress in your trading journey

Empowering Retail Traders

At The Trading Playbook, I share insights and lessons learned during my journey from a novice trader to becoming a profitable retail trader. Articles will focus on strategies, techniques, tools and resources to help you navigate the world of trading stocks, futures, and options while avoiding common pitfalls facing retail traders.

Trading Playbook Blog

-

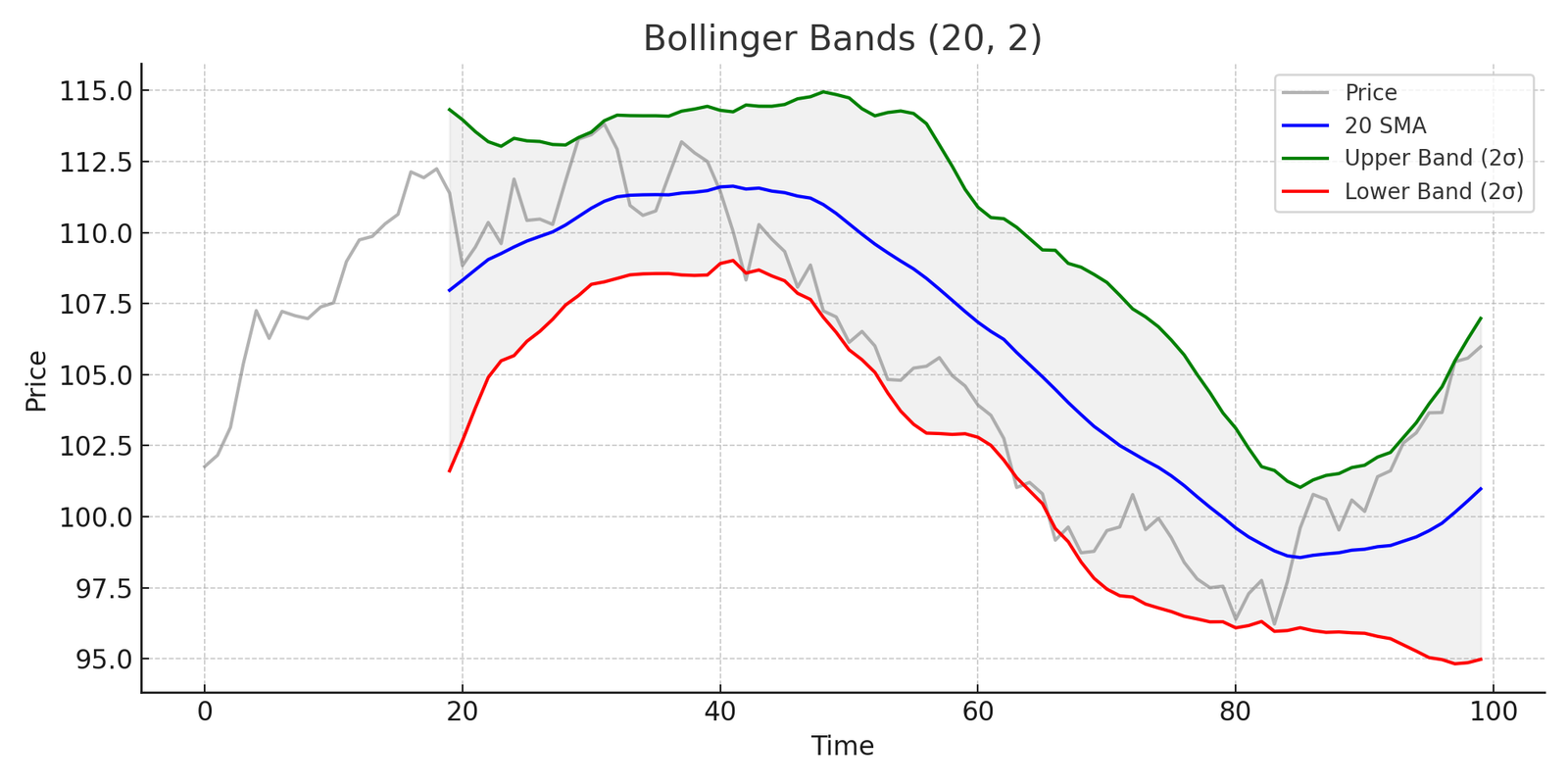

Mastering Bollinger Bands: Strategies and Insights

Bollinger Bands were created by John Bollinger in the 1980s, and are one of the most versatile and widely used…

-

Developing a Technical Analysis System for Market Direction

Introduction to Technical Analysis Technical analysis is a method used to evaluate and forecast the movement of securities’ prices by…

Master Your Trading

Follow The Trading Playbook to enhance your trading skills, avoid common pitfalls, and achieve success in the markets.